The Mainland Moment – Your Trusted Source for Global News, Insights & Review

The Mainland Moment – Your Trusted Source for Global News, Insights & Review

Meta Platforms: A Comprehensive Look at the Tech Giant's Evolution and Impact

Meta Platforms has changed from a college dorm experiment into a global technology titan that shapes how billions connect, communicate, and experience the digital world. A firm known for its social media behemoths of Facebook, Instagram, and WhatsApp, Meta knows more than a few things about innovation and controversy.

Whether it’s a bold move by Mark Zuckerberg into virtual reality (VR) and the metaverse, or the company’s tussles over data protection, the story of Meta is one of ambition, resilience, and constant reinvention.

In this extremely elaborate blog, we will cover Meta’s journey, the massive ecosystem in which it operates, the controversies it has faced, and its current position in IT and otherwise. Expect facts, lists, tables, and real insights no fluff, just the good stuff.

Why Meta Platforms Matters

In 2023, Meta’s Threads app skyrocketed to 100 million users in just five days, a record-breaking launch that shook up social networking. Or consider that in 2024 alone, Meta raked in over $135 billion in advertising revenue, proving its online services remain a goldmine.

Meta Platforms is more than just a company; it is a force that transgresses almost every corner of the internet. Under the leadership of CEO and founder Mark Zuckerberg, Meta owns some of the biggest names in social media, including Instagram and WhatsApp, and is currently placing big bets on AI, AR, and VR ventures like Oculus. But its rise hasn’t been smooth.

From the Cambridge Analytica scandal to debates over privacy and regulation, Meta’s journey is as complex as it is fascinating. Let’s dive into how this corporation evolved and why it’s still making headlines.

The Evolution of Meta Platforms

Meta’s history is a rollercoaster of growth, pivots, and challenges. Here’s how it became the powerhouse it is today.

From The Facebook to a Social Media Giant

Back in 2004, Mark Zuckerberg, a Harvard student with a knack for coding, launched TheFacebook a simple platform to connect college kids. By 2006, it dropped the “The” and opened to the public as Facebook, quickly becoming a network sensation.

And then came another leap – in 2012, Facebook went public with an IPO of $104 billion, one of the largest ever in history. Capitalization for the social network skyrocketed after buying Instagram for $1 billion within the same year and WhatsApp for $19 billion in 2014.

Data breaches within the Cambridge Analytica scandal in 2018 that affected 87 million users caused some serious privacy issues with regard to Meta and brought some early cracks in its foundations.

Key Milestones<gwmw style

- 2004: TheFacebook launches.

- 2008: Hits 100 million users.

- 2012: IPO and Instagram acquisition.

- 2014: WhatsApp joins the family.

The Metaverse Vision Takes Root

By 2018, Zuckerberg’s visionary eyes turned toward virtual reality and augmented reality. The foundation was laid through the acquisition of Oculus in 2014, which cost $2 billion, and now Meta’s Reality Labs division is pouring money into VR headsets and immersive experiences.

It is a 3D, all-encompassing digital universe of simulation where people could perform their tasks, socialize, and have fun. It is not merely a techno dream but perhaps an answer to the sluggish growth of social media and the ever-increasing competition from TikTok. “The metaverse is the new frontier,” said Zuckerberg in 2021 to herald a new era for Meta.

The Rebrand to Meta Platforms

In October 2021, the company Facebook, Inc. renamed itself Meta Platforms, a new name to reflect the pivot to a metaverse focus. It was not coincidental whistleblower Frances Haugen leaked documents that exposed the lax data protection and misinformation policies and so, imploding public trust.

The rebrand aimed to shift the narrative, but reactions were mixed. Tech fans saw potential in VR and AR, while critics, including Elon Musk, quipped, “Meta? More like ‘meh-ta.’” Still, it marked a turning point for the corporation.

A Rocky 2022: Losses and Layoffs

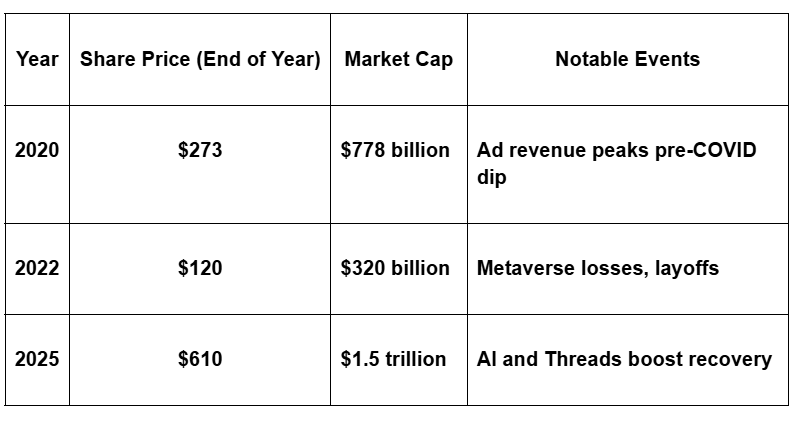

2022 tested Meta’s resolve.Ad revenues suffered terribly and plunged the stock down by more than 60%, reducing the market cap by $700 billion during an international economic slowdown. Reality Labs bled $13.7 billion, whereas Horizon Worlds flunked with fewer than 200,000 active users, far from the target of 500,000.

In November, Meta cut more than 11,000 jobs (13% of its workforce), a sharp turn to efficiency.“We need to become leaner,” Zuckerberg admitted, hinting at tough times for his leadership.

2023 Revival: Threads and AI Power Up

Meta roared back in 2023. The Threads app, a microblogging rival to Twitter, launched in July and hit 100 million sign-ups in days though many users didn’t stick around. Meanwhile, artificial intelligence became Meta’s secret weapon.

AI-driven ad tools boosted revenue, and Innovations like generative AI for content creation kept users hooked. By 2025, Meta’s stock soared past $600 per share, pushing its valuation to $1.5 trillion. The technology gamble was paying off.

Meta’s Stock Performance (2020–2025)

Meta’s Business Ecosystem

Meta isn’t just Facebook it’s a sprawling network of acquisitions, revenue streams, and infrastructure driving its dominance.

Mergers and Acquisitions: Strategic Growth

Meta’s acquisition spree has been a masterclass in expansion. Beyond Instagram and WhatsApp, it bought Oculus ($2 billion) for VR, CTRL-Labs ($1 billion) for neural interfaces, and Giphy ($400 million) for online engagement. Each purchase bolstered Meta’s technology stack, from social media to immersive tech. But regulators aren’t thrilled the FTC’s 2020 antitrust lawsuit aims to break up Meta, claiming it stifles competition.

Major Acquisitions List

- Instagram (2012): $1 billion photo-sharing king.

- WhatsApp (2014): $19 billion global messaging.

- Oculus (2014): $2 billion virtual reality pioneer.

- Giphy (2020): $400 million GIFs for engagement.

Revenue Engine: Advertising Dominance

Advertising is Meta’s lifeblood, accounting for 97% of its $135 billion revenue in 2024. With 3.9 billion monthly active users across its apps, Meta averages $34 per user annually far outpacing Twitter’s $10. AI-powered algorithms refine targeting, keeping Meta ahead of Google ($200 billion in ad revenue) but wary of TikTok’s rise

Advertiser Landscape: Scale and Shifts

Over 10 million businesses advertise on Meta’s platforms, from mom-and-pop shops to giants like Coca-Cola. In 2025, some advertisers balked at relaxed moderation (more on that later), but AI tools lured others back with hyper-precise reach. “Meta’s AI ads are unmatched,” said a Shopify exec, highlighting its automation edge.

Facilities and Infrastructure: Going Global

Meta’s physical footprint is massive. Its Menlo Park HQ anchors a network of offices in 80+ cities, from Dublin to Singapore. Data centers like the $10 billion Louisiana site unveiled in 2024 power AI and cloud services, handling 600 petabytes of data daily. Meta touts 100% renewable energy usage, though Greenpeace argues its carbon footprint still rivals small nations.

Case Study: Louisiana Data Center

- Cost: $10 billion

- Jobs Created: 5,000+

- Purpose: AI training, metaverse hosting

- Green Claim: 100% solar and wind-powered

Power, Policy, and Controversy

Meta’s influence goes beyond tech it’s a political and cultural lightning rod.

Lobbying Muscle: Shaping the Rules

In 2024, Meta spent $20 million on lobbying, outmuscling rivals like Amazon ($18 million). With 79 lobbyists, including ex-White House aide Joel Kaplan, Meta pushes for favorable AI and VR laws while dodging antitrust crackdowns. Its $1 million donation to Trump’s 2025 inauguration raised eyebrows, cementing its leadership in policy influence.

Censorship Tightrope: A Policy Pivot

Meta’s moderation history is messy. During COVID-19, it cracked down on misinformation, banning 20 million posts. But in 2025, Zuckerberg flipped the script, allowing slurs and hate speech unless flagged. “More speech, less censorship,” he said, sparking FTC probes and user outrage over compliance with GDPR and regulation.

Disinformation and Misinformation Battles

The Cambridge Analytica fiasco exposed Meta’s data vulnerabilities—50 million profiles harvested for political ads. Haugen’s 2021 leaks revealed ignored red flags on election lies. Today, Meta leans on crowdsourced “Community Notes” for fact-checking, but critics warn it’s a recipe for online chaos.

Hate Speech Dilemma: Free Speech vs. Safety

Meta’s 2025 policy shift greenlit anti-LGBTQ+ and anti-immigrant rhetoric, prompting boycotts from brands like Unilever. Supporters cheer its free speech stance, but a 2025 UCLA study found a 30% spike in hate incidents tied to Meta’s platforms. The privacy vs. openness debate rages on.

Lawsuits Piling Up: Legal Headaches

Meta’s legal woes are mounting:

- FTC Antitrust Case (2020–ongoing): Seeks to split Instagram and WhatsApp.

- Ireland GDPR Fine (2023): €400 million for data protection breaches.

- Kelly Stonelake Suit (2025): $100 million claim over gender bias in AI hiring.

These cases threaten Meta’s valuation and reputation.

Leadership and Governance

Who’s steering this technology ship? Let’s meet the key players.

Management Heavyweights: Zuckerberg and Co

Mark Zuckerberg, with 57% voting power, is Meta’s executive heart. His bets on AI and the metaverse define its path. COO Javier Olivan keeps operations humming, while Nick Clegg, ex-UK politico, handles global affairs. Their leadership balances innovation with crisis management.

Board of Directors: Power Dynamics

Meta’s board blends tech savvy (Peggy Alford, ex-PayPal) with clout (Dana White, UFC boss). Yet, it’s often called a Zuckerberg rubber stamp, given his control. Diversity exists, but ethical oversight lags as Meta pivots policies.

Governance Challenges: The Zuckerberg Factor

Zuckerberg’s grip limits shareholder say, sparking governance debates. “He’s a king, not a CEO,” quipped investor Peter Thiel in 2024. The board struggles to check his visionary risks like Reality Labs’ $15 billion loss in 2024.

Meta’s Place in the World

Meta’s global reach is vast, but it’s not without scrutiny.

Tax Affairs: Playing the Game

Meta funnels profits through Ireland, paying just $2 billion in global taxes on $40 billion in 2024 profits—a 5% effective rate. The EU and US push for fairer financial rules, but Meta’s blockchain-like tax agility keeps it ahead.

Reception: A Mixed Bag

Billions love Meta’s apps, but trust is shaky only 28% of users trust Facebook with their data (Pew, 2025). Critics mock its metaverse hype, yet investment in Meta’s stock hit record highs in 2025, showing Wall Street’s faith.

Conclusion: What’s Next for Meta Platforms?

Meta Platforms has weathered scandals, stock crashes, and skepticism to remain a technology titan. From social media dominance to AI breakthroughs and the Threads app, it’s rewriting its story.